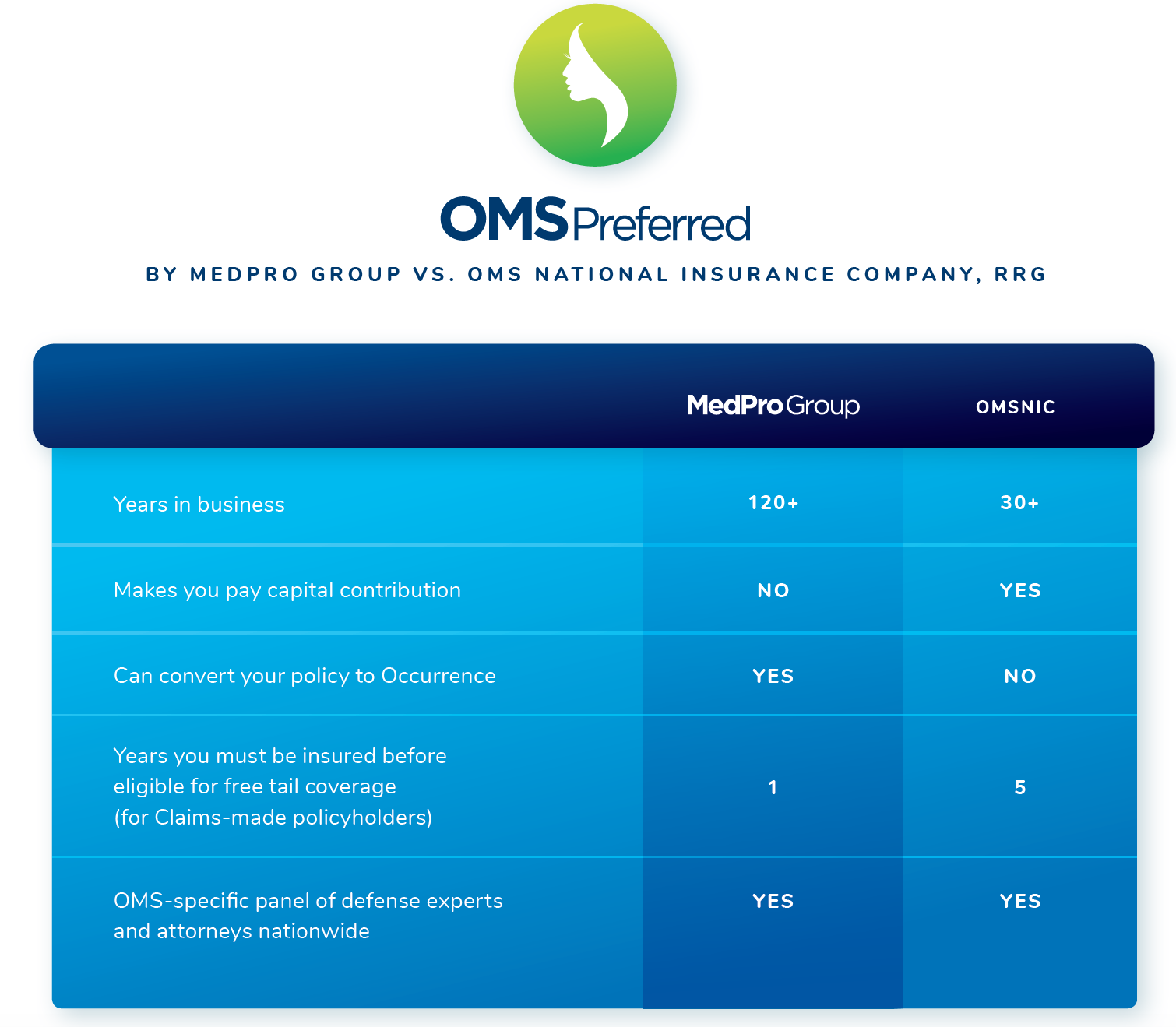

Malpractice Protection from MedPro Group

Your trusted GDIS team is excited to offer you professional liability insurance through MedPro Group — an industry-leading carrier providing comprehensive coverage at a competitive cost. We believe you shouldn’t have to pay high fees to get the claims handling and risk management experience you deserve.

Offering Superior Protection

MedPro Group is the only insurance carrier to offer OMS:

BETTER COST

You won’t pay capital contributions when you switch. In fact, we have a variety of premium credits which have helped OMS save thousands on their annual premiums.

BETTER DEFENSE COVERAGE

We defend OMS using 120+ years of claims experience across the healthcare spectrum and the nation’s leading defense counsel. These are some of the reasons we close 80% of claims without payment and hold a 95% trial win rate.

BETTER CARRIER

We’re the strongest carrier in the industry—a Berkshire Hathaway company with an A++ rating from A.M. Best. Our unmatched financial stability combined with our successful defense track record allows us to fiercely defend claims while maintaining affordable premiums.

Financial Strength

As a Berkshire Hathaway company with an A.M. Best financial strength rating of A++ (Superior), MedPro has over 120 years of experience in this industry. MedPro's stability ensures that the company is well-positioned to protect oral and maxillofacial surgeons well into the next century. It's a promise we feel confident making.

Flexible Policy Options

Unrivaled Claims Defense

Winning a malpractice case often requires resources outside of the OMS profession. That’s why we defend you using 120+ years of claims experience across healthcare, the nation’s leading defense counsel, and over 7,000 of the best expert witnesses.

If your company only insures OMS, they may not have the breadth of resources and insights to best defend your case. Being covered by a company with experience across professions can be the deciding factor in a malpractice lawsuit — and we have the winning record to prove it. We close 80% of claims without payment and hold a 95% trial win rate.

Pure Consent to Settle

We give you the right to refuse to settle a claim — unlike many insurance competitors who have exceptions in their consent provision. If you want to fight your claim in court, you should have the right to do so.

Price

We don't make you pay a capital contribution and we offer a variety of premium credits. In fact, OMS can save thousands when they switch to us.

Additional Information

MedPro Group internal data 2011-2017. All competitor information derived from financial statements, regulatory filings and competitor websites and is current as of 1/23/2017. A.M. Best rating as of 7/14/2017. This comparison is an educational tool designed to help you learn about the insurance coverage and the various details you may want to consider when selecting your healthcare liability policy. We value data integrity. If you believe that any information is incorrect, please contact us. In order to qualify for a free tail you must have a retroactive date at least 48 months prior to the date of retirement. The Convertible Claims-Made product will be offered by the Company, subject to its underwriting guidelines. If coverage is canceled during the three (3) policy years subsequent to the issuance of the Convertible Claims-Made product, insureds will owe the actual amount of premium that would have been charged for a separate extension contract had one been purchased at the time of the issuance of the Convertible Claims-Made product, subject to the terms and conditions of the policy. The additional premium shall be calculated at the filed rate for an extension contract endorsement at the time the Convertible Claims-Made product was issued and is due sixty (60) days from the date of cancellation. MedPro Group is the marketing name used to refer to the insurance operations of The Medical Protective Company, Princeton Insurance Company, PLICO, Inc. and MedPro RRG Risk Retention Group. All insurance products are administered by MedPro Group and underwritten by these and other Berkshire Hathaway affiliates, including National Fire & Marine Insurance Company. Product availability is based upon business and regulatory approval and may differ among companies. Visit medpro.com/affiliates for more information. ©2017 MedPro Group Inc. All Rights Reserved.